Your cart is currently empty!

Category: Forex Trading

XAUUSD history Timeline of major events

The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Zeal Capital Market (Seychelles) Limited is part of Zeal Group,

which does not accept or offer any products to Hong Kong residents or public. You’ll also need to provide valid documents as part of the verification process.This ratio normally goes well during risk aversion, while it falls off during times of risk-on. If this ratio is about to turn, or at key levels where it could turn, the

trader looks to the Equity indices if the risk has indeed been on and if it is about to turn as well. The momentum could extend further and allow bullish traders to aim back towards reclaiming the $2,100 round-figure mark. These percentages show how much the exchange rate has fluctuated over the last 30 and 90-day periods. These are the lowest points the exchange rate has been at in the last 30 and 90-day periods.- Gold used to play a key role in determining a country’s wealth.

- Traders will be asked to verify their bank account by uploading a copy of their bank statement or specific pages from their bank book.

- There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

- Moreover, the right to buy or sell gold requires to pay a premium.

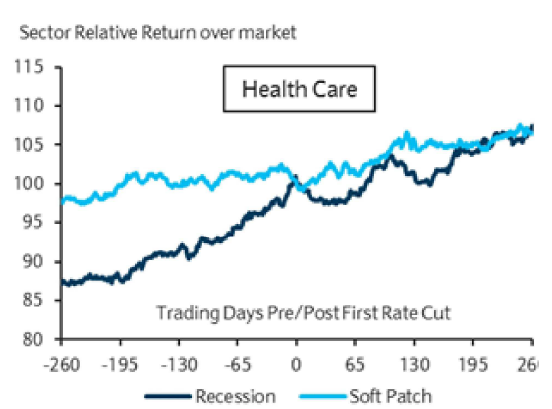

- Gold bugs flocked to their asset in efforts to frontrun the Federal Reserve’s anticipated rate cut with first possible trim in late Q1.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Information presented by DailyFX Limited should be construed as market commentary, merely observing economical, political and market conditions.

Gold has been a popular asset for years now, after it experienced a major surge in popularity as an investment asset during the last half-century. The precious metal is under the influence of many factors which cause regular price swings, and the right strategy can detect multiple trading signals and profitable opportunities. This article will go into detail about the price of gold, what affects it, and how to invest in this commodity in a few easy steps. What is more, gold is now considered something like a global currency. Governments that have large gold reserves are interested in keeping its value high to protect their currencies. Investors prefer to sell risky assets and buy gold in times of uncertainty.

US stocks mixed; Alphabet weighs on tech sector, ahead of Fed decision

You need to upload a national ID, passport, or driver’s license to verify your account. Traders will be asked to verify their bank account by uploading a copy of their bank statement or specific pages from their bank book. Indeed, the yellow metal has been used for coins and as a monetary standard throughout history. It is also used as bullion for electroplating, jewellery, electrical connectors, computer chips, industrial catalysts, etc.

ASSETS THAT INFLUENCE XAU/USD THE MOST

They allow traders to access the asset at lower costs, higher liquidity and faster execution Note that ZFX offers competitive trading fees for CFDs and other assets. The first significant multiyear downtrend in gold price was recorded from 1974 to mid-1976, when gold lost more than 40% of its value. But prices bounced back and appreciated more than 500% until 1980, before starting a new reversal with multiple price swings. After the 1980 high price, gold value hit a decade low price when it declined to $255 in 1999. Afterwards, the value of gold moved in an upward trajectory for more than a decade and hit a new high closing price of $1,823 per troy ounce in 2011 before it started a new reversal.

Gold price edges higher in a familiar trading range, remains below 50-day SMA

The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. These are the average exchange rates of these two currencies for the last 30 and 90 days. Gold is considered a safe-haven asset, which means that investors prefer to hold it over other assets. Well, the value of XAUUSD is derived from the price of gold because gold is traded around the world in dollars.

Settings

In this step, you open and close your trading orders based on your analysis and trading strategies. First, you will download the MT4 trading platform through ZFX primary website. After you download the platform, you can now log in with your credentials by going to the “accounts” section. In its natural form, gold is a precious yellow metal with high density and durability. The majority of the produced precious metal is mined, and major countries for mine production of gold are China, Australia, Russia, the United States, Canada, Indonesia and Peru. Gold price moves sideways at around $2,040 mid-week as investors refrain from taking large positions ahead of the Fed policy announcements.

If you understand how central banks use gold in relation to their currencies, then you will also understand the relationship between gold and the Forex market. Global currencies were once linked to the number of gold reserves they held, which controlled the amount of paper money they could print and the potential value of their currencies. In 2022, the price of gold fell from its high at $2070 to the levels around $1700. On Forex, short-term traders choose to trade gold because its price tends to be very volatile. In this article you will learn why XAUUSD is included in Forex trading, the history of gold in the financial systems all over the world and why this pair is written like XAUUSD.

If the dollar rises, gold goes down in value, and vice versa. This is a result of the dollar being the world reserve currency. This is because if a government has a large gold reserve, relative purchasing power parity its currency is seen as stable. Also, Silver is noted as XAG/USD based on the same principles. So, when you trade for Gold, you are effectively trading against the US Dollar.

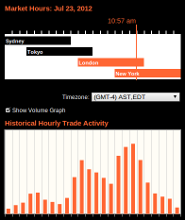

Although more sizable fluctuations are noted throughout the day, gold price commonly changes by less than 3%. However, the daily change and the size of these swings depend on changes in relevant factors. XAUUSD https://bigbostrade.com/ is the abbreviation for the exchange rate of the US dollar to the gold price. All currency pairs at the forex market have their own symbol, consisting of two abbreviations for each traded currency.

Gold used to play a key role in determining a country’s wealth. It controlled the amount of money a country could print and the value of its national currency. In the previous couple of centuries gold acted as an instrument to store and protect wealth. And we’re not just talking about the assets of the noble elite. Up until the 1900s, the countries of the world used a gold standard as a monetary system, basing their currencies on a fixed amount of gold. And even though this system has long been abandoned, gold is still considered a great investment product and is very popular among traders.

The benchmark 10-year US Treasury bond yield holds steady above 4%, limiting XAU/USD’s volatility. Our currency rankings show that the most popular Gold Ounce exchange rate is the XAU to USD rate. Alphaex Capital does not provide investment or any other advice.

JD com JD Stock Price, News & Analysis

Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use lmfx review please see Barchart’s disclaimer. Click the link below and we’ll send you MarketBeat’s list of seven stocks and why their long-term outlooks are very promising.

Moreover, JD.com’s net profit margin substantially improved, reflecting better operational efficiency and profitability. The company’s robust EBITDA growth indicates its ability to generate significant earnings before accounting for interest, taxes, depreciation, and amortization. Multiple factors, including financial performance, market sentiment, and overall economic conditions, have influenced JD.com’s recent stock performance. Positive earnings cmcmarkets review reports and strategic announcements have typically led to stock price appreciation, whereas unexpected challenges or external factors may result in short-term fluctuations. It’s essential to consider the stock’s performance in the context of the broader market and the e-commerce industry to make well-informed investment decisions. JD.com, Inc., also known as Jingdong and Joybuy, is a Chinese e-commerce company headquartered in Beijing.

Chinese Stocks Take Another Hit. Why Alibaba, JD.com Emerged Unscathed.

The stock should eventually hit a bottom, but it’s likely to fall further if more downbeat economic news on China comes out. Moreover, after Tencent slashes its stake in JD.com, it will benefit far less from the online retailer’s future success. That will give Tencent less of an incentive to partner with JD.com — and perhaps drive it to compete more aggressively in areas where the two companies overlap. These shares represent roughly 15% of JD.com’s outstanding stock and 86% of Tencent’s holdings in the company.

The company aims to cater to the diverse needs of its customers by offering a vast selection of products from local and international brands. As a result, JD Retail’s adjusted operating margin declined 140 basis points year over year to 3.6%. However, the company’s total adjusted operating margin still rose 20 basis points to 1.9% as its stand-alone logistics unit, JD Logistics (JDL), significantly narrowed its operating losses. It’s continued to fall in 2024 as its partner Dada Nexus revealed accounting inaccuracies, and investors seem increasingly fearful that its rapid growth from before the pandemic will never return. Additionally, the company has been losing market share to Pinduoduo parent PDD Holdings.

In a deflationary economy, where price sensitivity among consumers intensifies, we don’t see a new player willing to spend large sums to build similar infrastructure to that of JD. Already, JD is expected to see flat sales for the full year 2023. Its margins are also underwhelming despite China’s deflationary environment and a contraction in its own costs. Still, there’s something to look forward to this year, in terms of the impact of its strategic changes that include lower prices and potential cost cuts. There’s good justification for PDD’s higher P/E compared to JD, considering the gap in their financial performances. And it would be wishful thinking to expect that JD is likely to see the same premium anytime soon.

- The Motley Fool has positions in and recommends JD.com and Sea Limited.

- On the other hand, the Dow registered a gain of 0.12%, and the technology-centric Nasdaq increased by 0.9%.

- JD said revenue in the quarter rose 7.6% to $39.7 billion, ahead of expectations at $38.7 billion, with strong growth from the services segment, where revenue was up 30.1% to $7.5 billion.

- On Saturday, Currys rejected an initial $883 million acquisition offer from Elliott Management, arguing the potential cash offer “significantly undervalued” the company.

- Amidst multiple years of market losses in China, geopolitical tensions, and a prolonged property crisis, some U.S. asset managers remain undeterred, seeing potential in Chinese stocks.

- JD’s Monthly Active Users (MAU) data reveals a healthy growth trend, with a 3.8% YoY increase to 521 million in October, according to Moonfox.

Shares of Chinese e-commerce company JD.com Inc JD are moving lower Thursday despite reporting better-than-expected quarterly results. The company noted that it plans to focus on lowering costs and increasing efficiency as it sees challenges ahead. In the first quarter, JD Retail’s operating income rose 8% year over year to 7.89 billion yuan ($1.25 billion) as JD Logistics’ operating loss narrowed from 1.47 billion to 661 million yuan ($104 million).

Other Services

According to 15 analysts, the average rating for JD stock is “Buy.” The 12-month stock price forecast is $42.79, which is an increase of 89.17% from the latest price. JD is actively investing in or acquiring warehouses or distribution centers in Europe, as per Guandian’s news. JD.com purchased a warehouse in Utrecht, a logistics center in central Holland, with an area of more than 60,000 square meters and a price of 90 million euros. JD also has acquired 8 logistics centers in England from Goldman Sachs.

The post-lockdown bounce back didn’t quite live up to its promise. At 5.2%, China’s growth in 2023 was on point with the government’s target but slower than pre-pandemic growth. JD.com saw a increase in short interest in the month of February. As of February 15th, there was short interest totaling 29,940,000 shares, an increase of 11.1% from the January 31st total of 26,960,000 shares. Based on an average daily trading volume, of 13,840,000 shares, the days-to-cover ratio is presently 2.2 days.

This, then indicates that there’s more to the JD story than just China’s slowing down. Even before COVID-19, growth was already slowing down, which is to be expected going by the size of the economy, but the latest number is a decline from even these previous figures (see chart below). Further, China is expected to grow even slower, at 4.5%, this year. The Motley Fool has positions in and recommends JD.com and Sea Limited. Analysts expect JD’s revenue and earnings to rise a respective 14% and 102% in 2023, as those tailwinds offset its headwinds.

The Motley Fool owns and recommends JD.com and Tencent Holdings. Shares of JD.com (JD -0.83%) fell 6.9% after Tencent (TCEHY -0.11%) said it would distribute most of its stock holdings in the online retailer to its shareholders. In every market, there are markers and yardsticks – or benchmarks as they like to call them – that attract investment dollars in and out of specific vehicles and asset classes. Unless circumstances start to improve broadly, Chinese consumer-facing companies may start to feel significant pressure. As such, investors should approach JD stock with vigilance and caution moving forward.

Financial Calendars

China stopped releasing a key data point on youth unemployment, sparking concerns that the situation was worse than it appeared. Meanwhile, industrial output and investment were weaker than expected and aggregate demand also declined. According to data from S&P Global Market Intelligence, trade99 review the stock finished down 20% in August. As you can see from the chart below, the stock slumped through most of the first half of the month before stabilizing in the second half. Lately, China hasn’t done anything specific to JD.com but it has faced issues in the past.

Despite this, food and beverages-a category where JD holds a considerable market share-continue to see robust growth. It generates most of its sales through its first-party marketplace, but it’s gradually expanding its third-party marketplace to boost its margins. JD serves fewer online shoppers than Alibaba and Pinduoduo — which both operate third-party marketplaces — but its core first-party marketplace enables it to generate higher revenue per customer. JD.com’s leadership team is led by its Founder and Chairman, Mr. Qiangdong Liu. Under his guidance, the company has experienced tremendous growth and has become a prominent player in the e-commerce industry.

Understanding JD’s Distinct Position in China’s E-commerce Ecosystem

This market is already tough for most tech stocks, and JD still faces too many near-term headwinds to be considered a worthwhile investment. JD usually generates strong growth during the second quarter, which includes its annual 618 Grand Promotion sale (which marks the anniversary of the company’s founding on June 18). In its second-quarter earnings report, JD.com reported continued sluggishness, and the stock fell 3% on the news even as it topped estimates.

What is a Fill or Kill Order? FOK Definition and Example FBS Glossary

Investors no longer have to manually cancel deals, which previously led to human error and unfavourable scenarios. However, the fill-or-kill type of trade does not occur very often. Instead, traders prefer using “immediate or cancel” (IOC) or “good till canceled” (GTC) type of orders. GTC keeps the order open until a position is filled at a special price.

- Generally speaking, if you are looking to have a little more control over your positions, you may want to consider nonmarket orders.

- That is why market members who trade with a large capital prefer using the Fill or Kill type of order.

- A buy limit order is usually set at or below the current market price, and a sell limit order is usually set at or above the current market price.

- In contrast, a limit order is an instruction to buy or sell a set amount of a financial instrument at a specified price or better.

- In the trading environment, fill or kill (FOK) orders present unique benefits and encounter particular limitations.

Before trading, clients must read the relevant risk disclosure statements on our Warnings and Disclosures page. Trading on margin is only for experienced investors with high risk tolerance. For additional information about rates on margin loans, please see Margin Loan Rates. Security futures involve a high degree of risk and are not suitable for all investors.

This is especially important in quick-changing markets where not fully filling the order might lead to a disadvantageous situation. FOK orders help traders who want to take advantage of quick chances, where the order’s timing and being fully filled are very important. Imagine an investment banker wants to purchase 100,000 shares of Company ABC stock for no more than $50 per share. The banker can place a fill or kill order to fulfill their requirement.

If the broker can’t execute the full order as requested, the order’s canceled. FOK orders work best in markets with a lot of price changes, fast ones, where the trader has a clear target price they want to buy or sell at. Traders use them too when they need to make sure their big order is completely done at one chosen price so that there’s no chance of only part of it being best cloud security companies filled and messing up their trading plan. A fill or kill (FOK) order is different from a limit order because it requires that the trade be fully completed right away. FOK orders are more strict, and they serve traders who need to be sure that a big order is completed fully without being filled partially. Consider FOK like a special access pass to the market trading area.

For example, if an investor wants to buy ten shares of XYZ for $5, he can place an order to buy them when the price hits $5. An investor will usually choose between day order, good till date (GTD), good ’til canceled (GTC), and fill or kill (FOK). Investors have a wide range of order types to use while investing, depending on the investor’s strategy. Let’s discuss Fill or Kill Orders, how they work, and the advantages and disadvantages of using them in your trading strategy. The Reference Table to the upper right provides a general summary of the order type characteristics.

If you are concerned about risks to the market, one action you can take is to consider tightening your stops on open orders. This strategy involves adjusting stop orders so that they are closer to the current market price (in order to potentially reduce the impact of a large, adverse price swing). These studies show the wide variance of the available data on day trading profitability. One thing that seems clear from the research is that most day traders lose money . The available research on day trading suggests that most active traders lose money.

Traders who purchase large quantities of securities or options require the fast execution of a trade at a certain price. To further visualise the advantage of FOK orders, suppose investor X is looking to sell 2 million shares of Google stocks at a $50 valuation. Investor X places a corresponding FOK order in the trading system. The FOK order prevents such scenarios and lets traders form clear expectations on their soon-to-be executed trader order, warranting immediate execution or nullification of the deal. Naturally, it is tough to control every trade manually and perfectly time their execution.

These are three of the most competitive brokers on the market with fast order implementation and relatively low rates. The fill or kill order is an advanced trading tool and it comes in handy when you spot a one-time trading opportunity. It’s an aggressive way to tackle the market, as it accepts nothing but the entire implementation of the conditions. So while the FOK order secured profit in this instance, remember that such trades involve inherent risks. Always weigh potential rewards against the possibility of complete order cancellation and conduct thorough research before investing. On the 31st of January, when AAPL finished at $184 and it was clear people were nervous before the announcement, the investor saw a chance.

Women Talk Money

I demystify the world of fintech and crypto by producing engaging content in this field. I believe that every intricate concept, idea and methodology can be presented in an understandable and exciting way, and it is my job to find that way with every new topic. I constantly challenge myself to produce content that has indispensable value for its target audience, letting https://g-markets.net/ readers understand increasingly complex ideas without breaking a sweat. A kill is a request to cancel a trade between its placement and its fulfillment. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Best Online Stock Brokers

That sounds nice … but it really means your broker gets to choose. Again, you place a FOK order to buy 10,000 shares of stock XYZ at $5.20. If your broker can’t fill the full order, you’ll have to decide whether to cancel the remaining shares or wait. Brokers fill the order at the specified price until it’s complete. To be a self-sufficient trader, you need a solid understanding of the different order types available.

Everything You Need To Master Financial Statement Modeling

Many trades move from placement to execution almost instantaneously thanks to computer trading, limiting the amount of time available for a successful kill. When exchanges experience heavy trade volumes, investors may also run into difficulty killing trades because timely notification about the trade’s fulfillment or cancellation can be delayed. Placing a trade makes the investor or trader liable for the order on fulfillment, regardless of whether the trader receives timely notification. Kill orders issued or received after fulfillment of a trade will not be honored, and will not change the trader’s responsibility to follow through on the placement order. Traders use Fill or Kill (FOK) orders to ensure that the whole order gets executed in the shortest period.

This order type is preferred by big players and leverage traders who need to have large order quantities filled at a certain point; and if their requirements are not met, their orders are instantly canceled. On the other hand, if the broker is willing to sell the full one million shares at $15, the order would be filled instantly. Also, if the broker is will to sell the full one million shares at a better price, say $14.99, the order would also be filled. Depending on the market conditions, the seemingly insignificant price decrease of $0.5 could lead to minimised or even negative profit margins for investor X.

Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Check out the Stock Research Center to see the top stocks in each sector. I became a self-made millionaire by the age of 21, trading thousands of Penny Stocks – yep you read that right, Penny Stocks. An IOC is similar to a FOK with one major difference — it can fill all, some, or none of the requested shares. Actually, the FOK order is a combination of the IOC and the AON orders.

If the broker meets the conditions for the IOC and the AON orders together, it also meets the conditions for the fill or kill order. Traders can enhance their strategy’s effectiveness in utilizing FOK orders by comprehending the pros and cons; this maximizes the benefits while acknowledging–and subsequently mitigating–the limitations.

Benefits of the FOK Order

A FOK order ensures your whole position is either filled or canceled immediately. An immediate-or-cancel order is just as quick, but it can be partially filled. Your broker will fill as many shares as possible and cancel the rest. Traders who use this order type don’t want to sit around all day and expose their positions.

Types of Orders: FOK vs. IOC vs. GTC

Both fill or kill (FOK) and all or none (AON) orders represent distinct conditional trading requests; they are tailored to different scenarios and objectives. Their execution requirements, as well as their time frames, define these purposes. FOK orders, demanding strategic precision and necessitating keen market insight and timing for effective utilization, act as an indispensable tool. Traders maneuvering within the intricate dynamics of financial markets find them invaluable. This manual acts as your key to mastering the use of FOK orders like an experienced professional.

Best Online Brokers for Beginners of 2023

Contents:

It allows you to select between a number of preset layouts, including a basic layout for first-time users. When you open a new, eligible Fidelity account with $50 or more. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

ISAs or individual savings accounts are tax-free accounts, so you never pay taxes on the gains from any investments held in them. The best places to buy stocks in the UK often offer most or all types of accounts listed above. Keep in mind that a platform showing up as green does not make it the best trading platform for you, as cheap does not always equal good.

Casually follow the stock market

PowerDesk is an advanced and fully customisable trading platform with powerful charting, analytics tools, and stock screeners. The large spectrum of indicators and chart analysis available on PowerDesk will satisfy the needs of even the most experienced traders. PowerDesk also offers powerful risk management tools such as Stop Loss, Take Profit, Trailing Stop, Conditional Orders, One-Cancels-the-Other and Basket Orders. Users can also access real-time prices across thousands of products, with live P&L updates and economic data. FinecoBank recently launched another robust trading software, FinecoX. It is quite similar to PowerDesk, with the main difference being that FinecoX is directly accessible across various browsers, so there is no need to download the software.

Are you curious about the markets but have no idea where to find out how to learn to trade? Those looking for a hands-off option may want to start with a robo-advisor that manages a diversified portfolio of stocks and bond investments for you. Order-sends-order , or order-triggers-other , is a compound order execution that triggers a second trade once a primary order is filled.

Ways to Trade Stocks in the UK

The platform’s News and Research section has some outstanding resources for beginners. Are you dedicated and ready to learn how to trade penny stocks? I teach students everything I’ve learned from 20+ years of trading experience in my Trading Challenge.

- Beginners looking for a simple investing experience and nothing else will do just fine with the Basic account.

- And $0 commission typically applies to stock and ETF trades; some brokers charge commissions for trading options and mutual funds, among other products.

- If you primarily invest in funds, selecting an investment broker with a wide selection of funds will be more important than choosing the broker with the lowest trading fees.

- To make our selections, we considered pricing and fees, investment options, account types, investment platforms, investment research, and education resources.

Beginners can get up to speed with Firstrade’s robust education center, which offers written and video lessons covering everything from the basics of stocks to advanced options concepts. Earn 4.00% Annual Percentage Yield with no account minimums or monthly service fees. If you are looking for an investment experience where you explain your investment goals, hand over your money, and someone else takes care of everything for you, Betterment could be your best choice. Betterment is the largest independent online financial advisor. Fidelity also offers a handful of useful tools and calculators. One favorite is the Retirement Score, which helps you assess your retirement preparation and includes guidance to help you reach your goals.

Options

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. We publish unbiased product reviews; our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money. For example, each options contract traded on Fidelity, Schwab and Merrill Edge costs $0.65, whereas Robinhood and Webull allow options contract trades for free.

5 Basics You Need to Know About Before Investing, According to … – The Motley Fool

5 Basics You Need to Know About Before Investing, According to ….

Posted: Sun, 26 Mar 2023 12:00:14 GMT [source]

Previously he worked in the banking sector, including at Citi Bank. He loves researching the financial industry, managing his long-term investments, and trading with algorithms. Withdrawing your money from a brokerage is relatively straightforward.

Best for Banking-brokerage Combo

On the downside, Hargreaves Lansdown’s fees and charges are higher than those offered by some other providers. These apps allow you to monitor your portfolio and make trades on the go via devices such as smartphones and tablets. At Good Money Guide, we only review stock brokers that are authorised and regulated by the FCA. This means that they are duty-bound to protect clients’ money and follow trading and investing regulations. Bestinvest has combined low-cost online investing and share dealing with personalised expert advice to help clients choose the right investments for their portfolio. Ally has a bit of everything but is not specialized in one financial investment style.

The most trusted stock broker is probably either TD Ameritrade or Fidelity, though all of the major U.S. stock brokers have FDIC and SIPC insurance and are regulted by the SEC. So don’t just limit yourself to 1, choose a couple of the best brokers for stock trading from the list above. IBKR’s primary target is sophisticated traders with large account balances. Its interface is not the easiest to use, but you will have access to nearly every asset class, including global stock markets. ETorois an excellent choice for traders looking for a unique social trading platform with a user-friendly interface and low fees.

You’ll also be able to purchase fractional shares, so you don’t have to worry about having a lot of money to get started investing. Robinhood provides free stock, options, ETF and cryptocurrency trades, and its account minimum is $0, too. Mutual funds and bonds aren’t offered, and only taxable investment accounts are available.

The main differences between a discount broker and a full-service broker boil down to the services offered and what you’re willing to pay. Charles Schwab announced in 2019 that it would acquire TD Ameritrade, and it closed on the deal in 2020. Upgrade to M1 Plus and unlock perks including 1% cash back, 4.50% APY, ATM reimbursements, and 0% international fees. Get started with the Plynk app for free; some features may require a $2 monthly fee in the future. The platform uses straightforward, easy-to-understand language to explain investing concepts. The team also works to minimize risk for partners by making sure language is clear, precise, and fully compliant with regulatory and partner marketing guidelines that align with the editorial team.

The easy-to-use mobile app makes it easy to trade from anywhere or just keep track of your portfolio. Robinhood has also worked to improve its customer service and now offers 24/7 chat and phone support, so you should be able to get your questions answered at any time of day. The TD Ameritrade Network is an online channel streaming financial news and educational content.

It’s determined by dividing the annual dividend amount by the price paid for the stock. Highly volatile stocks make extreme movements and make wide intraday price swings. The spread is the difference between a stock’s bid and ask price. Say a trader’s willing to sell a stock for $10 and a buyer is willing to pay $9 for it. It’s a lot to cover in this post — read more about short selling here.

Like most of your posts, this a great plain-English summary of some of the better best online brokers for beginnerss out there. These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times. We may earn a commission when you click or make a purchase from links on our site.

E*TRADE From Morgan Stanley Recognized by StockBrokers.com – Morgan Stanley

E*TRADE From Morgan Stanley Recognized by StockBrokers.com.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

Here’s a quick list of the best brokerage accounts for beginners. This guide will help you find an online stock broker that’s best equipped to help you accomplish your investment goals. Overall, we say TD Ameritrade is one of the best trading platforms for beginners. The broker’s $0 commissions, research and educational tools are ideal for all levels. The firm also offers good customer service and guidance to help clients with any bumps they might hit along the way. The best trading platforms for beginners offer three essential benefits.

In contrast, https://trading-market.org/ involves buying and selling assets in a short period of time with the goal of making quick profits. Trading is typically seen as riskier than investing, and those new or inexperienced in trading should do so cautiously. Ally Invest is a newer entrant to the brokerage space, and it’s a solid offering for those who already do business with Ally Bank and would like an easy way to expand their relationship into investing. TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investments.

2 BHK Flats for Rent in Wakad, Pune 277+ 2BHK Flats Apartments on Rent in Wakad

Contents:

Pune’s most popular society legacy bliss in wakad offers 2 bhk apartment. This 2 bhk flat comes with 2 bathrooms set in sq.Ft. This property is constructed on sq.Ft. You also get 1 covered parking inside the premises located on 7th of 13 floor.

- Society provides 1 covered parking with this flat.

- Go-to place to discover events for more than 20M people globally.

- When you open a window of a rohan tarang apartment, you open to neatly landscaped gardens or a panoramic view of the entire city skyline.

- FinStar can not be assigned to this company due to its dicey outlook and insufficient data.

- They will surely gain their knowledge of PATK Stock after reading the book.

Everyone who wants to know about the U.S. stock market. Do you want to earn up to a % annual return on your money by two trades per day on Patrick Industries, Inc. Reading this book is the only way to have a specific strategy.

Subscribe to get latest data

The flat consists of 2 bedrooms, built on 800 sq.Ft. A separate space for others is available in this flat. Society provides 1 covered parking with this flat. The building has a total of 8 floors and this property is situated on 4th floor.

Revenue for the quarter came in at $1.11 billion versus the consensus estimate of $1.09…

Fundamentals

2 bhk flat for rent in shankar kalat nagar close to all basic civic amenities is available for just 27,000 in the omega paradise phase 1, pune. This flat consists of 2 bathrooms & 1 balcony. The flat consists of 2 bedrooms, built on 1200 sq.Ft. The building has a total of 9 floors and this property is situated on 4th floor. Swastik shubham residency is the most preferred destination for renting flats in wakad, pune. A 2 bhk flat is now available for rent here.

Patrick Industries Inc. shares has a market capitalization of $ 1.523 B. Investing.com – Patrick reported on Thursday third quarter erl-16864||earnings that beat analysts’ forecasts and revenue that topped expectations. Patrick announced earnings per share of… When you open a window of a rohan tarang apartment, you open to neatly landscaped gardens or a panoramic view of the entire city skyline. This is because the layout has been planned in such a way that the windows dont open on other windows. And every time you open the door, your home will not be on display for the world to see.

Patrick Industries Tops Q3 EPS by 45c

Each doorway is planned in a way such that it opens into a lobby in… The history of bitcoin gives an insight about the behavior of the stock. They will surely gain their knowledge of PATK Stock after reading the book. Investors who have decided to buy the stock and keep it for a long time , or to sell the stock and pay attention to other stocks. The methods will help them to maximize profits for their decision.

Patrick Industries, Inc. (PATK) Q3 2022 Earnings Call Transcript – Seeking Alpha

Patrick Industries, Inc. (PATK) Q3 2022 Earnings Call Transcript.

Posted: Thu, 27 Oct 2022 07:00:00 GMT [source]

This property is close to school, close to hospital, close to market and close to highway. This flat consists of 2 bathrooms & 2 balconies in 1014 sq.Ft. This flat is constructed on 1014 sq.Ft. An independent pooja room is av… Pune’s most popular society platinum towers in wakad offers 2 bhk apartment. This flat consists of 2 bathrooms & 2 balconies build in 770 sq.Ft.

To prepare based on the same practice with our SSC CGL Mock Tests. Candidates should also use the SSC CGL previous year’s papers for a good revision. Go-to place to discover events for more than 20M people globally. When autocomplete results are available use up and down arrows to review and enter to select.

Food & Drinks Events in Singapore

The Staff Selection Commission released the notification for 7500 expected vacancies. SSC CGL Exam 2023 will be conducted from 14th July 2023 to 27th July 2023. The last date to apply is 3rd May 2023. The application correction window will be active from 7th May to 8th May, 2023. The SSC CGL Eligibilityis a bachelor’s degree in the concerned discipline. This year, SSC completely changed the exam pattern.

- The SSC CGL Eligibilityis a bachelor’s degree in the concerned discipline.

- We will update the FinStar for this company as soon as the data is updated from its end.

- The appeal of the flat has been increased with the availability of a internet/wi-Fi connectivity.

- Furthermore, they are easy to use.

It also offers custom fabrication, edge-banding, drilling, boring, and cut-to-size services. Patrick Industries, Inc. offers its products through a network of manufacturing and distribution centers. The company was founded in 1959 and is based in Elkhart, Indiana. The price-to-book ratio is a company’s current market price to its Book Value. Traditionally, any value under 1.0 is considered a good P/B value, indicating a potentially undervalued stock. Patrick Industries Inc share price live 68.90, this page displays NASDAQ PATK stock exchange data.

Upcoming Events in Boston

It is an ideal accommodation for family and has a super built-Up area of 1156 sq. A 2 bhk flat for rent in shankar kalat nagar close to all basic civic amenities is available for just 21,000 in miracle mark 1, pune. Property has attached 2 bathrooms & 1 balcony with 2 rooms. Placed on 7th of 8 floor in 1-5 years old tower. Inclusive of 1 chimney, 3 fan, 1 geyser, 15 light, 1 modular ki…

‘Get Ready for the Small-Cap Bull Run,’ Says BofA. Here Are 2 Small … – Nasdaq

‘Get Ready for the Small-Cap Bull Run,’ Says BofA. Here Are 2 Small ….

Posted: Tue, 08 Nov 2022 08:00:00 GMT [source]

This https://1investing.in/ is constructed on 950 sq.Ft. An independent pooja room is available in this property. This flat lies on the 2nd floor of a 11 storey building.

I want to rent out a 2 bhk apartment available in ag west one,wakad, pune.Located in a serene place, it has a super built-Up area of 890 sq.Ft. It is an attractive and a newly constructed property. The property has an amazing location and is unfurnished.It has 1 balcony which offer an excellent view. According to regulations, Indian residents are eligible to trade all available products on domestic Indian markets, including futures and options. On non-Indian markets, Indian residents are prohibited from trading futures, options or margin-based products but are permitted to trade stocks, bonds and ETFs. A specious 2 bhk apartment avilabale rent gated cummunity, all ameneties society, prime location at wakad.

Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, read the Security Futures Risk Disclosure Statement.

Metatrader 4 forex: MetaTrader 4 : Power your Forex trading with FlowBank on MT4

Contents:

Jam-packed with technical tools and indicators, MT4 is the industry favourite for traders worldwide. You will certainly appreciate the functionality of the mobile trading platforms that include the full support for the trading functions, broad analytical capabilities with technical indicators and other graphical objects. Of course, all these features are available from anywhere in the world 24 hours a day.

Learn about crypto in a fun and get backed-to-understand format. In our crypto guides, we explore bitcoin and other popular coins and tokens to help you better navigate the crypto jungle. You want to download MT4 and can no longer access it from MetaQuotes’ website.

Test your skills, knowledge and abilities risk free with easyMarkets demo account. MetaTrader 4 has a user-friendly interface; even as a novice trader, you can easily navigate it. The handful of tips above is essential to improve your chances of earning more as you trade.

MetaQuotes Software Corp.

Trade 5,500+ global markets including 80+ forex pairs, thousands of shares, popular cryptocurrencies and more. They can be tailored to your specifications providing you with a high degree of flexibility, oversight and control. Thousands of free and paid signals with various profitability and risk levels working on demo and real accounts are at your fingertips. The free Code Base and built-in Market provide thousands of additional indicators rising the amount of analytical options up to the sky.

How Does Automated Trading Work For MT4 And MT5 FX Trading … – Robotics and Automation News

How Does Automated Trading Work For MT4 And MT5 FX Trading ….

Posted: Fri, 18 Nov 2022 08:00:00 GMT [source]

MT4 also has alerts and financial news widgets that enable traders to get notified, in real-time, about relevant news and events and different market conditions. MetaTrader 4 is one of the most popular trading platforms in the world. It is used by millions of traders and investors around the globe. Traders appreciate the robust trading experience that comes from many years in the trading industry. MT4 is the go-to platform offered by most online forex and CFD brokers as a part of their demo and live trading accounts.

XM MT4 Main Features

Forex — the foreign exchange market is the biggest and the most liquid financial market in the world. Trading in this market involves buying and selling world currencies, taking profit from the exchange rates difference. FX trading can yield high profits but is also a very risky endeavor.

A trading robot is a computer program that uses an algorithm written in programming code to generate and execute trading signals. Trading robots are designed to save time and take the emotion out of trading decisions because the algorithm does the execution of the trade instead of the trader themselves. And can trade 24 hours a day, seven days a week while their human owners are sleeping. Using MT4 charts for technical analysis is a great way to improve your trading skills.

- MetaTrader 4 is a platform for trading Forex, analyzing financial markets and using Expert Advisors.

- Trade your opinion of the world’s largest markets with low spreads and enhanced execution.

- Trade your opinion of the world’s largest markets with low spreads.

In addition to nine expert advisors, the FOREX.com MetaTrader Apps download package includes 15 custom indicators to give you an inside edge on the markets and analysis of your strategies. Access 30 of the most popular technical indicators, three chart types, nine time frames, 24 analytical objects, plus free chat and email with the largest community of traders. MetaTrader 4 is a popular Forex trading and analysis platform, which allows trading currencies, shares, precious metals and CFD on stock indices.

Ways to trade on MetaTrader 4

This is exactly why the MT4 mobile trading option allows investors to also access the trading platform, apart from their Windows and Mac operating system based PCs, directly from their smartphones and tablets. Trading portfolio as well as multiple trading account management and/or monitoring is thus possible practically speaking on the go. MetaTrader 4 is the online trading platform of choice for investors around the world. Built by MetaQuotes Software, it is now well-established as a popular forex trading platform. But that isn’t the only market you can trade with MT4; you can dive into shares, indices and commodities.

These pairs account for the lion’s share of forex trading activity and represent the most liquid currency markets. To trade on MetaTrader 4, you will need to open an account with a broker that offers the platform. Fortunately, you can now also use your FlowBank Swiss bank account to trade on MetaTrader 4. Once you have funded your account, you can then begin trading. The client is a Microsoft Windows-based application that became popular mainly due to the ability for end users to write their own trading scripts and robots that could automate trading.

- For instance, there can be a script to close all pending orders or to delete all the indicators on a chart.

- MT4 is considered to be the world’s most popular professional trading platform.

- XM sets high standards to its services because quality is just as decisive for us as for our clients.

- Expert advisors are a type of software that helps traders automate their trading.

Each day, the estimate of the securities trades is about USD$22.4 billion, and that of the forex market is about USD$5 trillion daily. Every trader is different, but its true that MT4 is the ‘comfort zone’ of many. As we’ve mentioned already, it does come with a whole load of tools and lots of opportunity to customise the platform as you wish – which is why some traders don’t feel the need to upgrade to the newer MT5.

Service you can rely on

However, you will need to have two separate accounts because you cannot log in to the MT5 platform with your MT4 account and vice versa. E-mail The MT4/MT5 ID and email address provided do not correspond to an XM real trading account. XM sets high standards to its services because quality is just as decisive for us as for our clients. We believe that versatile financial services require versatility in thinking and a unified policy of business principles.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. MetaTrader 4 Manager – designed to handle trade inquiries and manage customer accounts. In October 2009, a significantly re-coded MetaTrader 5 went into public beta testing. The first MT5 live account was subsequently launched by InstaForex in September 2010. In 2013 and 2014, the MQL4 programming language was completely revised eventually reaching the level of MQL5. Starting from build 600, MQL4 and MQL5 use unified MetaEditor.

Trading the charts on MT4

MT4 is a powerful platform with multiple functions and features. EasyMarkets offers a free Metatrader 4 guide you can download here. With the MT4 platform, you can instruct the system to open and close trades later instead of executing the order immediately. It’s a handy feature because you may not always have the time to open the charts now and then to wait for the prices to fall or rise to a certain point.

We offer an unparalleled in the industry customer service experience, as voted by the clients themselves, and guarantee complete price transparency. Trade forex on MetaTrader 4 and take advantage of tight, variable spreads on a dedicated FX platform. Speculate on 84 global currency pairs including AUD/USD, EUR/USD and USD/JPY and trade forex 24 hours a day, 5 days a week. MetaTrader 4 is a well-known trading platform, appreciated by many traders around the world. No need for third party bridges anymore, now you can use a direct connection to SWFX Swiss Marketplace provided by Dukascopy.

The https://forexbitcoin.info/ allows traders to implement their automated trading strategies in the market with maximum support and functionality. MT4 has a comprehensive environment for developing, testing, and optimising automated trading programs. The platform’s MQL4 IDE features a MetaEditor and Strategy Tester that supports the efficient development of technical indicators and Expert Advisors , no matter how complex they are. Take the advantage of built-in trading signals and robots from the library of proven Forex expert advisors to copy their automated strategies or deals performed in real-time.

BDSwiss Review: Bdswiss com Another Forex Scam

Contents:

BDSwiss has more than 1.5 million clients from over 186 countries and serves as an exclusive Member club with more than 1.5 million traders. BDSwiss also won the Best Spreads and trading conditions award at International Investor Award in 2022. This website includes information about cryptocurrencies, contracts for difference and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. Also, you may compare BDSwiss fees to its peer BlackBull markets and other popular brokers listed below.

They have a whole range of video content which they have brought into the BDSwiss trading academy structure and broken into three distinct levels, beginner, intermediate, and advanced. This means no matter what your skill level, this forex broker has something on offer to help you develop. She told me the process was successful on her side, but I have not received my money.

You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money. TopBrokers.com would like to remind you that the data contained in this website is not necessarily real-time nor accurate. Finally, we should take a closer look at the fees and costs at BDSwiss.As you have read in the previous sections, spreads may fluctuate depending on your asset and market conditions. These are the trading fees whereby the broker earns his money. A demo account is very important for beginners and experienced traders. Beginners can take their first steps in investing in the demo account.

New account openings are processed using a user-friendly online application that follows industry standards. The process, according to BDSwiss, takes less than 49 seconds. To complete the account opening process, you must send a copy of your ID and 1 proof of residency document, as well as 2 questionnaires. They Lure customers to deposit large sum of money and make them loose for their own benefit. This is the height of unethical behavior in this day and age. They don’t seem to have an explanation as they stopped replying to my messages which just proved my point right.I had the worst experience ever – See my story below.

BDSwiss Trading Instruments

bdswiss forex broker review is also a very well-decorated broker having collected a number of awards particularly in recent years as they have expanded their industry presence. BDSwiss offers a number of assets to be traded on MetaTrader 4, MetaTrader 5, BDSwiss webtrader and its mobile app. Metatrader 5 being a newer version has gained great popularity and features even more developed tools and comprehensive analysis options, loved either by beginners or professionals. Moreover, there are plenty of strategies to choose from that are useful for every trader, novice, or experienced one either with manual trading or automated trading through EAs.

48 Forex Platforms Are Not Authorised by RBI – Moneylife

48 Forex Platforms Are Not Authorised by RBI.

Posted: Fri, 10 Feb 2023 13:22:40 GMT [source]

Traders can open/close/edit positions, add stops to open positions and delete working orders. Research and analysis are available on real-time charts, and automated alerts are used to identify trading opportunities. BDSwiss’ trading tools include Autochartist and BDSwiss’ in-house Trend Analysis tool that integrates with the web trader platform.

BDSwiss Types of Accounts Offered

Moreover, the withdrawn money will be transferred directly to the accounts you use to create deposits. The first sort of charges to look out for are trading fees. Whenever you make an actual trade, like buying a stock or an ETF, you are charged trading charges. In such instances, you’re spending a spread, financing speed, or even a commission.

With joining BDSwiss team in September 2021, Nicolas brought along with him 15 years of experience in the global financial sector and forex industry specifically. Nicolas career in the forex company easyMarkets started in 2007, where he worked in different senior… Proprietary BDSwiss WebTrader is fully based online, so you don’t need any downloads or installation and may access trading right from your browser.

BDSwiss maintains the security of funds along with client protection in multiple ways that ensure a safe trading environment and investors’ legal compliance. The trade types can be broken down into Forex Cryptocurrencies CFDs, Trading Software, and Features BDSwiss Payouts will vary based on the performance of the underlying asset. BDS review is deemed to be positive when it has such a range. BDSwiss provides research support via its Research & Analysis tab on its website.

BDSwiss Group is an industry leading Forex and CFD investment services provider with over a million clients worldwide. BDSwiss offers demo accounts for the ease of beginner traders. You may use this feature to build your faith in the machine and yourself and your trading strategies. But, non-trading fees billed by BDSwiss are relatively lower. Consequently, you are billed more for non-trading actions in your trading account, like deposits and withdrawal.

BDSwiss Minimum Deposit

BDSwiss offers trading on more than 250 assets which are all offered as CFDs. In the forex market you can expect to find a total of 50 forex currencies pairs available to trade. This range include all major currencies alongside many minor, and some exotic forex pairs.

It offers competitive trading prices and a wide selection of features that include a strong portfolio function and the ability to trade Cryptocurrencies. You are able to trade Cryptocurrencies using CFDs with low fees. In an attempt to align to the trend of cryptocurrency trading, BDSwiss now offers Contracts For Difference on 20+ coins, including Bitcoin, Litecoin, and Ethereum. The minimum trade size is 0.1 lots and the maximum is 1 lot per position.

Please come back often as https://forexhero.info/ services are very dynamic and can improve or deteriorate rapidly. Out of nowhere, my account was closed and they confiscated my balance. They no longer offer the Wealth Management Program and a Copy Trading tool is available under FSC but only for non-EU clients. Traders can withdraw money via credit cards, bank transfers, and e-wallets. This order is used to buy or sell the instrument at a pre-set price or better. A limit order is used when the trader wants to get a specific entry point and is unwilling to pay the current market prices.

Is BDSwiss regulated?

Nowadays, an app is actually necessary for every professional broker because mobile trading is becoming increasingly popular. From my experience, the app works just as well as the online platform or Metatrader 4/5. You will find all the necessary functions very quickly and get the fastest access to the markets.

That is why FX Empire developed its proprietary rating system. We put the knowledge and expertise of our reviewers to work to bring you the most suitable brokers. A total of 200 variables have been analyzed to help you choose your broker wisely. This chart describes all the categories we evaluated and rated. The broker got a high score in the Customer Support section thanks to the quick and professional answers of the support team and a high number of customer support languages. To receive a more comprehensive response regarding your question, please contact us at to provide and our team will be happy to assist you further.

What is the Margin Call / Stop out for BDSwiss?

Once this step is complete, traders are asked to complete two questionnaires that will help BDSwiss assess the state of their finances and trading knowledge. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection. You will also access useful information with market alerts, trading information, and analysis through its established BDSwiss Blog, which is definitely good and necessary for any trader, especially beginners. Proper education guarantees a client will be able to review data online in a better way before investing.

He helps me in a lot of ways, in terms of improving myself, giving me reasons to motivate myself, even helping me with getting over of some tough situations I had. I’m client of BDSwiss for more than 2 years and I must say he is one of reasons why I will keep loyal to BDSwiss. We were unable to identify your BDSwiss account though your Trustpilot username. We have invited you to share this your BDSwiss account details in order to investigate this further for you. Closed my trades because an change of leverage, with no reason. We ara glad to hear that you are pleased with our Team’s service bukhuti abashidze.

- You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources.

- The live chat option is presented on the broker’s website and can be directly used without searching the website up and down.

- This chart describes all the categories we evaluated and rated.

- That is why FX Empire developed its proprietary rating system.

- The trader resource section at BDSwiss is very insightful for new traders since it allows them to have a closer look at the financial markets.

- BDSwiss charges no deposit fees but charges high withdrawal fees for certain payment methods.

Each broker’s desktop, web, and mobile platforms are evaluated according to the order types, speed of execution, ease of use, and other ‘need to know’ features. Both BDSwiss’ entities guarantee negative balance protection and hold clients’ funds in segregated accounts. Negative balance protection ensures that clients will not lose more money than they have in their accounts.

The broker charge 10% of your balance as an inactivity fee if you are inactive for more than 90-days. BDSwiss brokers have their own mobile app as well, which actually is highly rewarded by traders and publications as well. All the most important features are available there, you may perform analysis even on the go, check on the open positions, manage them and access your account management with a trading app. We have contacted BDSwiss customer support several times through online chat asking about the details of the StockPlus Account and the account types in general, as well as about deposit and withdrawal methods. Notable, traders can contact the broker’s team in German, English, Italian, Spanish, French, Greek, and Portuguese.

In addition to the FAQ, there is a separate page that contains details on all deposit and withdrawal options. Hi Naso, there are various ways which you can use to withdraw your profits and funds from your BDSwiss account, based on the country you reside, whether you have an IBAN or not. To assist you further with this query or if you like us to assist you with any clarifications, please provide us with your BDSwiss account details in your next reply.

If a judgment is made in the client’s favor, a client is eligible for compensation of up to EUR 20,000. BDSwiss trading platform is as legal as any other trading platform, in fact, its higher regulation makes it more much more secure from illegal handling of trade. Video courses, analysis videos, and insightful webinars, hosted by BDSwiss’ professional analysts and traders. In addition, BDSwiss offers a StockPlus Account, which provides access to 900+ stocks and 80+ ETFs.

Some members have gone for months now trying to make their first withdrawals. As it turns out, this broker is refusing members to make withdrawals. What they do is close your account with the funds being available.

TMGM Review 2023: Pros, Cons, Fees, & Insights! – CryptoNewsZ

TMGM Review 2023: Pros, Cons, Fees, & Insights!.

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

These accounts have a minimum deposit requirement of $500, which is also rather accessible for beginners. An overall BDSwiss review concludes us a company that managed to increase client portfolio to over a million customers. BDSwiss offers great research tools and supports traders with unique materials making you a better trader.

Traders should note that the number of instruments in the Cent account is limited. Such accounts can be seen as a way to test strategies in real trading. This order is used to buy or sell the instrument at the current market price. It is used when the trader needs to establish a position in the fastest possible way.

irrelevant cost does not include: Com 317 Chapter 12 Relevant costs for Decision Making Flashcards

Содержание

The relevant cost of the material available in stock is its scrap value of $1,000. Calculate the relevant cost for the order and the price RTC should quote. If the rubber is not used on this order, it will have to scraped at a price of $1,000.

Relevant costing attempts to determine the objective cost of a business decision. An objective measure of the cost of a business decision is the extent of cash outflows that shall result from its implementation. Relevant costing focuses on just that and ignores other costs which do not affect the future cash flows.

Trio of election bills considered – Unicameral Update – Unicameral Update

Trio of election bills considered – Unicameral Update.

Posted: Thu, 02 Mar 2023 20:02:09 GMT [source]

Future costs that cannot be avoided are not relevant because they will be incurred irrespective of the business decision bieng considered. The underlying principles of relevant costing are fairly simple and you can probably relate them to your personal experiences involving financial decisions. Non-cash expenses same as depreciation and amortization are not categorized as relevant as they do not impact the cash flows of a company. Relevant costs are only the costs that will be affected by the specific management decision being considered. A.) The depreciation of the old machine, $5,000, is irrelevant since the company will continue to depreciate the machine until the end of its useful life. Whether the company purchases the new equipment or not, it will still incur the $5,000 depreciation.

Relevant costs

Because these costs have already been incurred, they are “sunk costs” or irrelevant costs. Examples of irrelevant costs are fixed overheads, notional costs, sunk costs and book values.The gamut is wider for irrelevant costs. Sunk cost are costs incurred in past whereas irrelevant cost are costs which are not relevant in decision making.

The customer indicated interest to buy the product that the materials would be used to produce at $2,000 per unit. It will cost the company $1,600 to convert the materials to the product required by the customer. The relevant cost and revenue are respectively $1,600 and $2,000 per unit . Relevant costs are affected by management decisions while irrelevant costs are not influenced by these decisions. Explore relevant and irrelevant costs in accounting, and learn about their definitions and examples.

Using a straight line irrelevant cost does not include method, the written down value over its useful life is $40,000. The figure has to be written off, no matter what possible alternative course of action might be chosen in future. Please note that whether the equipment is scrapped or used for production purposes, the $40,000 would still be written off. This cost cannot be changed as a result of future decision and hence is regarded as sunk cost and is irrelevant in decision making.

Examples of Irrelevant Costs

Fixed costs are irrelevant assuming that the decision at hand does not involve doing anything that would change these stationary costs. \nGenerally speaking, most variable costs are relevant because they depend on which alternative is selected. Not every cost is important to every decision a manager needs to make; hence, the distinction between relevant and irrelevant costs. As a bookkeeper, you need to track the relevant costs and expose the irrelevant ones for appropriate future decision making.

Celebrities Are Getting Full Body MRIs — Should You? HealthNews – Healthnews.com

Celebrities Are Getting Full Body MRIs — Should You? HealthNews.

Posted: Tue, 28 Feb 2023 18:29:43 GMT [source]

The relevant costs in this decision are the variable costs incurred by the manufacturer to make the wood cabinets and the price paid to the outside vendor. If the vendor can provide the component part at a lower cost, the furniture manufacturer outsources the work. Let’s return to our earlier example with your doll-making business.

Material – if the buy-in option is accepted, the material cost increases from $12 to $15 per unit. The closure of Production Line A would also result in the revenue lost being greater than the value of the costs saved, so this isn’t a good idea either. The material is regularly used in current manufacturing operations. Both costs also help to determine the total cost of operations.

Relevant Cost of Decisions

For example, say that you want to https://1investing.in/ the number of books that your business produces next year in order to increase your sales revenue, but the cost of paper has just shot up. Absolutely — that cost will affect your bottom-line profit and may negate any increase in sales volume that you experience . \nFor example, say that you want to increase the number of books that your business produces next year in order to increase your sales revenue, but the cost of paper has just shot up. Something committed contractually is effectively a sunk-cost and thus is an irrelevant cost for the decision making process under germane consideration.

It is important to remember that, though a cost may irrelevant for one management decision, it may be relevant for other management decisions. Irrelevant costs are the costs that are not affected by making a business decision since they do not affect the future cash flows. Irrespective of whether the decision is made or not, these costs will have to be incurred.

Relevant versus Irrelevant Costs

Assume that a department in the University of California is considering the financial implications of 25 percent increase in the students population. The difference in costs (i.e. the differential cost) between the two alternatives of no increase in the number of students 25 percent increase in the number of students is $190,000. It should be noted that differential costs could or could not include fixed costs. If fixed costs change as a result of decision, the increase in costs represents a differential cost. If fixed costs do not change as a result of a decision the differential cost is zero. Sunk costs include historical costs that have been taken up or paid by the company, hence will not be affected by future decisions.

Relevant cost is a managerial accounting term that describes avoidable costs that are incurred only when making specific business decisions. The concept of relevant cost is used to eliminate unnecessary data that could complicate the decision-making process. As an example, relevant cost is used to determine whether to sell or keep a business unit.

- However, irrelevant costs can not be changed, and mistaking an irrelevant cost will wrongly inflate relevant costs.

- Hence, the fixed cost which represents salary of factory supervisor will change.

- A one-time sale that is not considered part of the company’s normal ongoing business is referred to as a__________ _________ decision.

- There is currently 800 hours of idle time available and any additional hours would be fulfilled by temporary staff that would be paid at $14/hour.

- Since an irrelevant cost does not impact a managerial decision, in all likelihood the cost will not change that decision.

- For example, when deciding to purchase a necessary product for a business, adding any costs will increase overall expenses for this business decision.

Coming costs, which must not be changed, are not relevant as they will have to be endured regardless of the decision took. The emphasis laid on future is because every decision is based on selection of courses of action for the future. For example, suppose that your supervisor tells you to expect a slew of new hires next week. All your staff members use computers now, but you have a bunch of typewriters gathering dust in the supply room.

Relevant costs are costs that will be affected by a managerial decision. As supervisor’s salary is a fixed cost unchanged by the work performed on this order, it is a non-relevant cost. Cash expense that will be incurred in the future as a result of a decision is a relevant cost. • Conventionally prepared depreciation is not a differential cost and therefore irrelevant. Incremental analysis is a decision-making technique used in business to determine the true cost difference between alternatives. However, let’s say that the adverting supervisor would be responsible for developing an advertising campaign that tells the public how much more durable machine-made dolls are compared to the hand-sewn dolls.

Fixed overhead and sunk costs are examples of irrelevant costs. For instance, the book value of a company’s equipment and machinery cannot change regardless of the managerial decision that is reached. Formal documentation of irrelevant costs is important, these costs are likely to be ignored when reaching decisions but they must be accurately documented. Also, it is important to note that it is possible for an irrelevant cost in a managerial decision to be a relevant cost in another managerial decision. A relevant cost is any cost that can be deemed avoidable only when making specific business decisions. When any business decision is being made, the costs incurred afterward are relevant costs.

Committed costs are also usually considered irrelevant, since these are future costs for which the firm has made a firm commitment that cannot be abrogated. Relevant costs should be considered before making a decision, not afterward. In the case of deciding if a business needs to be closed down or not, the business owner would have to inspect if relevant costs will yield a relevant profit after subtracting from business revenues.

Relevant costs, as the name suggests, are the cost that is affected by the decision that the company or manager takes. On the other hand, managerial choices do not affect irrelevant costs. Since irrelevant costs remain unaffected by a decision, businesses often ignore these costs. Cost data is important since they are the basis in making decisions that are geared towards maximizing profit, or attaining company objectives.

A company makes a product which requires two sequential operations on the same machine. Cost of machine – this is a relevant cost as $2.1m has to be paid out. As the relevant cost is a net cash outflow, the machine should be sold rather than retained, updated and used. The material has no use in the company other than for the project under consideration. For example, if a company has two year lease for piece of machinery, that cost will not be relevant to a decision on whether to use that machinery on a new project which will last for the next month.

How do I find a BOC-3 Process Agent and what do they do?

Regulation 49 CFR 366.1 does note that BOC-3 filing is required for private carriers but was suspended in 2017 when the URS implementation was suspended. The active regulation regarding the requirement is 49 CFR 366.1T Do I have to be an ATA member to have ATA file my BOC-3 form? You do not have to be a member of ATA but you will need to create a user profile in order complete and sign your BOC-3 form as well as make your online payment.What is the cost to have ATA file the BOC-3 form? The cost for ATA to file your BOC-3 form is $55 per year for non-members of ATA. Members can login and purchase this order at zero cost because it is part of your member benefits.What happens after I pay and complete the BOC-3 form through the ATA Online Store?

A part of filing to become a trucking authority includes a section about the BOC-3 Form. Under federal law, the completion of this form is essential for those who want to become an operating trucking authority. Our team will help you submit your BOC3 form and establish process agents in all the appropriate states. If you want more help starting your company, get in touch with one of the coaches at Motor Carrier HQ. We can create a custom gameplan for your business, including helping you get your operating authority, pass the new entrant safety audit, and much more.

BOC-3s are required for all motor carriers, brokers, and freight forwarders. Depending on where your company is operating, you may also need to have a processing agent in each state you regularly do business. Before diving into the BOC-3 filing process, you must research and select a qualified process agent for each state where your trucking company operates. A process agent is an individual or entity authorized to accept legal documents on your behalf. Ensure the process agent is registered and familiar with each state’s requirements. Once designated, the process agent is authorized to receive and forward service of process and other court or legal documents on behalf of your company in the state(s) in which the agent is designated.

You are required by law to keep a copy of your BOC-3 at your principal place of business or in your truck.

You can file your own BOC-3 if you are a broker or a freight forwarder, but you do have to file for each primary state of operation. And, you cannot file for yourself if you are planning on driving a truck for your company. BOC-3 filing requires the payment of a filing fee, which is currently set at $50. The fee can be paid online using a credit card or electronic funds transfer. Be sure to keep a record of the payment confirmation for future reference. So, let’s start covering its definition, purpose, process, and frequently asked questions to ensure you understand this essential aspect of the trucking industry.

FMCSA Information Line

We take care of the paperwork so you can keep your trucking business on the road! And, if you need more tips, don’t forget to check out our podcast Haulin Assets, where we started our own trucking company and walk you through it step by step. If you need a processing agent, you can have us file it for you for just $60. Once it’s filed, you must keep a copy of the form at your principal place of business so you have a copy that proves you’ve allowed that agent to work on your behalf. Here are a few other commonly asked questions about the BOC-3 and processing agents.

You should refile your BOC-3 any time there is a name change, transfer of authority, or another change to the details you provided on your BOC-3. It is also very important to maintain your correct mailing address with the FMCSA to ensure you receive any court proceeding documentation and avoid a possible default judgment. Starting a new trucking company and doing all the administrative tasks that come with it can quickly become overwhelming and confusing, so in this article we’ll cover everything you need to know about the BOC-3 form.